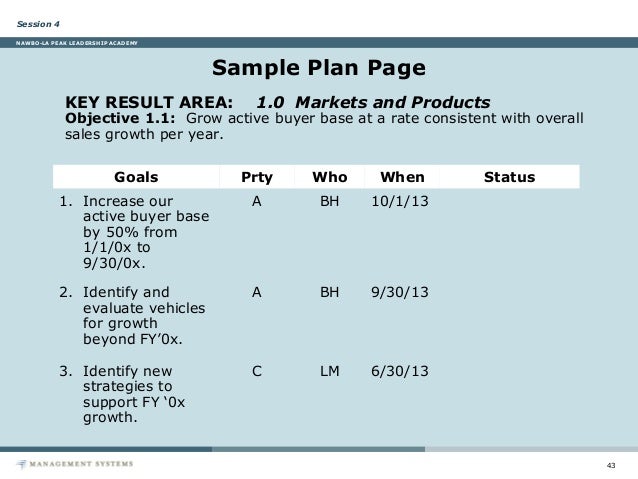

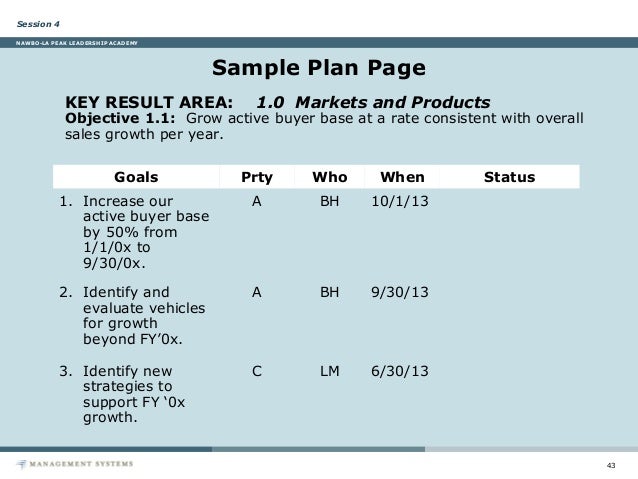

Step 4: ITR-V would be downloaded in step four. Step 3: Select the income tax return’s acknowledgment number from which you wish to get the ITR-V. Step 2: Choose “Income Tax Return” and “Assessment Year” from the menu. Step 1: Log in and choose the “View Returns / Forms” option on the Income Tax E-Filing website.

Then the following steps are followed for itr computation download: The department automatically creates the ITR-V Acknowledgement and to the person with the registered email id.

When you provide ITR for Scholarship or School Admission. When you apply Bank Home Loan or Car Loan or Mortage Loan. In Following case mainly ITR Computation Documents is Required ITR Computation is required mainly by the bank or credit companies or VISA Offices or any other official purpose where your ITR is required. If you do not respond to the e-verification notices, chances are high that the case would be selected for scrutiny,” Gupta said.Download ITR Format Why ITR Computation is required ? “The 68,000 cases picked up for e-verification was based on mismatch between tax return filed and the data received from source with regard to deposits. The risk parameters for picking returns for e-verification would be set every year, Gupta said, without disclosing the criteria for selection of an ITR for e-verification. “Once an assessee files updated ITR, there are less chances of his/her case getting picked up for scrutiny or re-assessment,” Gupta said. Taxpayers have time till March 31, 2023, to file updated returns for income earned in 2019-20 fiscal. However, no response has been received in the remaining 33,000 cases. Of this, in 56 per cent cases or 35,000 cases the taxpayers have already satisfactorily replied to the notice or filed updated tax return,” Gupta said. “On a pilot basis, about 68,000 cases pertaining to the 2019-20 fiscal have been taken up for e-verification based on risk management parameters set by the department.

0 kommentar(er)

0 kommentar(er)